Why Is a Tax Return Transcript Important for Latinos Living in the U.S. and How Can You Get One? If you’re living in the United States, there may come a time when you need to prove your tax status for important matters like applying for credit, buying a home, or handling legal procedures.

So, how can you do this? The easiest and most official way is to request a tax return transcript from the Internal Revenue Service (IRS). It might sound complicated, but don’t worry! Below, we’ll explain step by step how you can obtain this document and why it’s important for you. This way, you can complete the process quickly and hassle-free.

First, let’s take a look at what a tax return transcript is.

What is a tax return transcript?

A tax return transcript is essentially a summary or copy of your federal income tax return.

This document includes most of the information you originally submitted on your tax form, as well as any changes that may have been made afterward. It’s issued by the IRS and is recognized by various financial institutions and government agencies.

A tax return transcript can be especially helpful when you’re applying for things like credit, a mortgage, or public assistance, as it serves as proof of your income. It’s also often required in legal situations where you need to provide evidence of your reported income.

In short, it’s a key document that can come in handy in many official processes!

How to Fill Out a Tax Return?

Getting a copy of your tax return transcript is easier than you think! Whether you need it for a loan application, immigration process, or another official matter, just follow these steps to get it quickly.

1. Gather the Necessary Information

The IRS needs to verify your identity before issuing your tax transcript. Make sure you have the following:

- Your Social Security Number (SSN)

- Your date of birth

- Your filing status from last year’s tax return (e.g., single, married filing jointly, etc.)

- The exact mailing address used on your last tax return

2. Visit the IRS Website

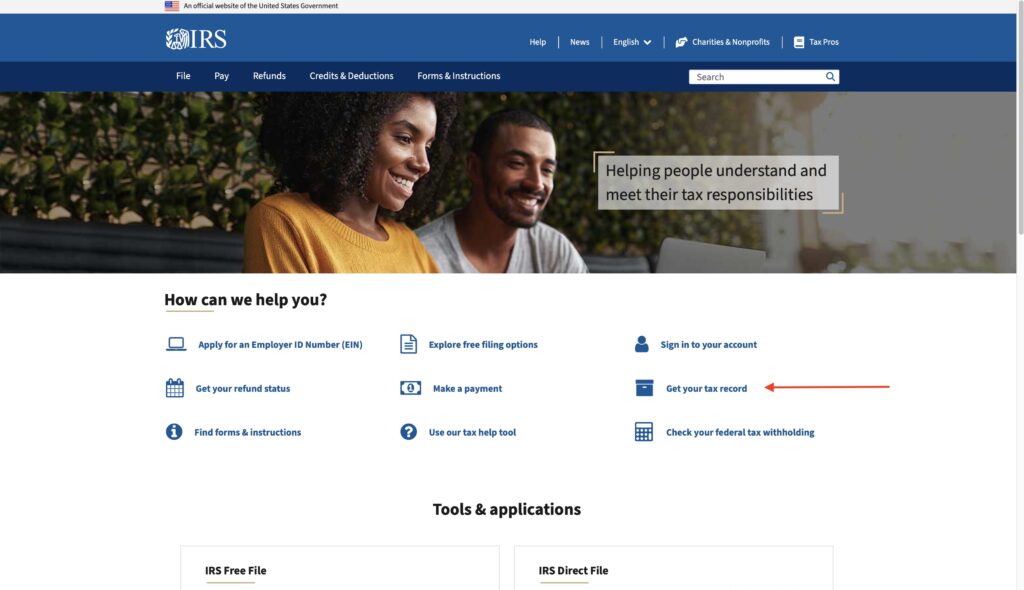

Go to the official IRS website and navigate to the “Get Your Tax Record” section.

3. Create an IRS.gov Account (If You Don’t Have One)

If you already have an IRS.gov account, simply log in. Otherwise, follow these steps to create one:

- Click on “Get Transcript Online”

- Follow the instructions to verify your identity.

- This process may include answering questions about your financial history and providing a phone number registered in your name for two-factor authentication.

4. Request Your Transcript

Once logged in:

✅ Choose the type of transcript you need (e.g., “Tax Return Transcript”)

✅ Select the tax year you need

✅ Download it instantly or request a mailed copy

5. Alternative Methods: Request by Phone or Mail

If you cannot access the transcript online, try these options:

📞 By Phone: Call 800-908-9946 and follow the automated instructions.

📬 By Mail: Download Form 4506-T from the IRS website, complete it, and mail it to the address listed on the form.

6. Receive Your Transcript

- If you requested it online, you can view and download it immediately.

- If you requested it by mail, it should arrive within 5 to 10 business days.

Extra Tips!

✔️ Make sure your contact information with the IRS is up to date to avoid delays.

✔️ If you have trouble with the online process, double-check that you’re entering your details exactly as they appear on your last tax return.

By following these simple steps, you can get your tax transcript with ease. If you run into any issues, don’t hesitate to contact the IRS for assistance!

Advantages and Benefits

There are many benefits and advantages to obtaining your tax return transcript. Here are some of them:

✔ Income Verification In processes such as credit applications, mortgage transactions, or public assistance, you may need to verify your income. A tax return transcript is accepted by financial institutions and government agencies as an official proof of your income. This plays an important role in your applications.

✔ Helps with Credit Applications When applying for credit, you may need a document that shows your income and tax status. A tax return transcript can help with the approval of your credit because it provides accurate and up-to-date information about your financial history.

✔ May Be Required in Legal Situations Tax return transcripts are often required in legal situations where you need to provide proof of income. In cases like divorce, child support, or debt recovery, income information may be requested.

✔ Tracking Your Tax Status A tax return transcript contains all the details about your previous tax returns, which can help you keep track of your tax status. It’s especially useful for reviewing past corrections and your tax payment status.

✔ Quick and Easy Access You can easily access your tax return transcript online. This document, which can be instantly downloaded from the IRS website, saves you time and speeds up your application processes.

✔ Required for Government Benefits To qualify for government benefits such as public assistance or social security payments, you may be asked for proof of income. A tax return transcript can be a necessary document for these types of benefit applications.

✔ Assists in Financial Planning When managing personal finances or planning for retirement, your tax return transcript is valuable as it shows your income and spending history. This can help you set and achieve your financial goals.

This document is not only valuable for official processes but also crucial for helping you understand and manage your financial situation more effectively.

In this content, we provided information on what a tax return transcript is used for and how to obtain it. For more details, please feel free to contact us.